QUICK SUMMARY

This blog explores how IVR systems are revolutionizing customer support in the insurance industry. From automating payments to personalizing service, you’ll discover the top uses, benefits, and steps to implement a smart IVR solution that saves time, cuts costs, and improves client satisfaction across your insurance operations.

Customer service is a key foundation in building relationships with your customers. How would you achieve that? Yes, through good communication. And who is responding to that? Your customer support team.

This team of expert communicators talks on behalf of your company. But is it scalable? I mean, think this way, while your human agent team is limited, they can handle a limited number of calls, and most of them are not really worth the attention or manual effort required.

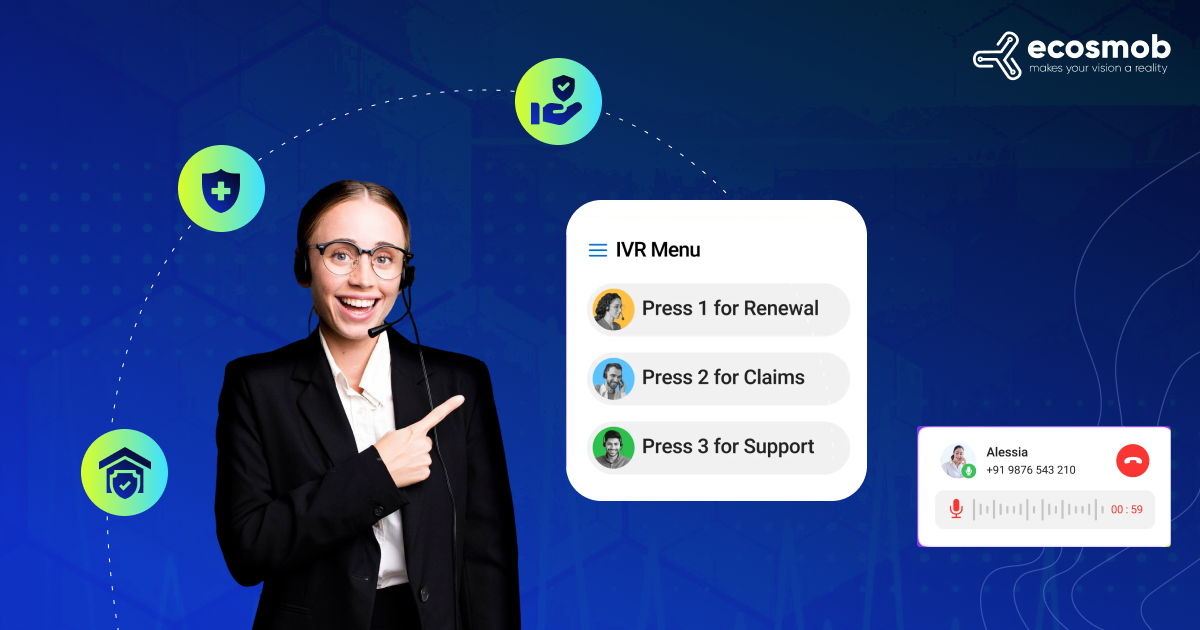

With an IVR system for insurance companies, you can automate the whole process. It allows you to design predefined steps that your customers will go through when they try to reach you on your customer support number. If the issue or information they want is listed in the menu and available, then, boom. The customer query is resolved without a human agent. Well, this is the magic of an IVR system.

An IVR offers more in the insurance industry. In this blog, we will understand the benefits of IVR in insurance industry, where it can be used, and what value it brings to the table. We will also look at how you can implement one.

Handle high call volumes efficiently without hiring more staff using a cloud-based IVR

Why IVR for the Insurance Industry?

First, let me congratulate you on taking the brave step of starting your own empire in the insurance industry. I understand how challenging the insurance business can be.

The insurance market is large and highly competitive, with new players entering the industry each year. While these factors may be concerning, it’s also important to consider the management of operations. A significant aspect of running an insurance business is customer service, which requires ongoing communication with clients. This includes everything from making sales pitches to assisting customers with policy claims.

You can implement an IVR (Interactive Voice Response) solution in your insurance company to save your team time and effort and reduce operational costs associated with additional human resources.

With IVR, you can automate the process of managing initial customer calls related to product inquiries or service issues. This system allows customers to resolve their queries automatically and connects them to a human agent when necessary.

The list continues if we discuss the different use cases or benefits of IVR in insurance industry operations. In the next sections, we’ll explore some of the most important ones.

Top 5 Uses of IVR in Insurance Companies

An IVR system can help you automate these repetitive processes while improving customer experience. Here are five practical ways IVR in insurance is used today:

1. Processing Payments

IVR systems in insurance companies make it easy for your customers to pay premiums over the phone at any time, even outside business hours. Once integrated with your payment gateway, customers can enter their policy number and make secure credit card or bank payments without needing to speak to an agent. This reduces pressure on your support team and ensures that customers always have a payment option available.

2. Gathering Customer Feedback

With IVR, you can automatically collect customer feedback after key interactions like claim submissions or support calls. After a customer finishes a call, the smart IVR solution can prompt them to rate their experience or answer a few quick questions. This helps you monitor service quality, improve team performance, and make data-driven decisions based on actual customer input.

3. Relaying Policy Information

Instead of waiting on hold to speak with a representative, customers can simply call in and navigate through the IVR menu to access important policy information. Whether they need to check coverage details, renewal dates, or policy status, IVR systems provide real-time answers without involving your agents. This not only improves service speed but also improves customer satisfaction.

4. Checking Claim Status

One of the most common inquiries insurance companies receive is about the status of claims. With IVR, your customers can check their claim status by entering their claim number or policy ID. The system pulls the latest update from your backend and shares it with the caller instantly. This reduces inbound calls for your agents and gives customers the convenience they expect.

5. Offering Security and Compliance

Security is critical in the insurance sector, especially when dealing with payments and personal data. A smart IVR solution is designed with built-in security layers, such as caller authentication and 256 encrypted data processing, to ensure compliance with standards like PCI-DSS or HIPAA. This gives your customers peace of mind and helps you maintain operational integrity without manual oversight.

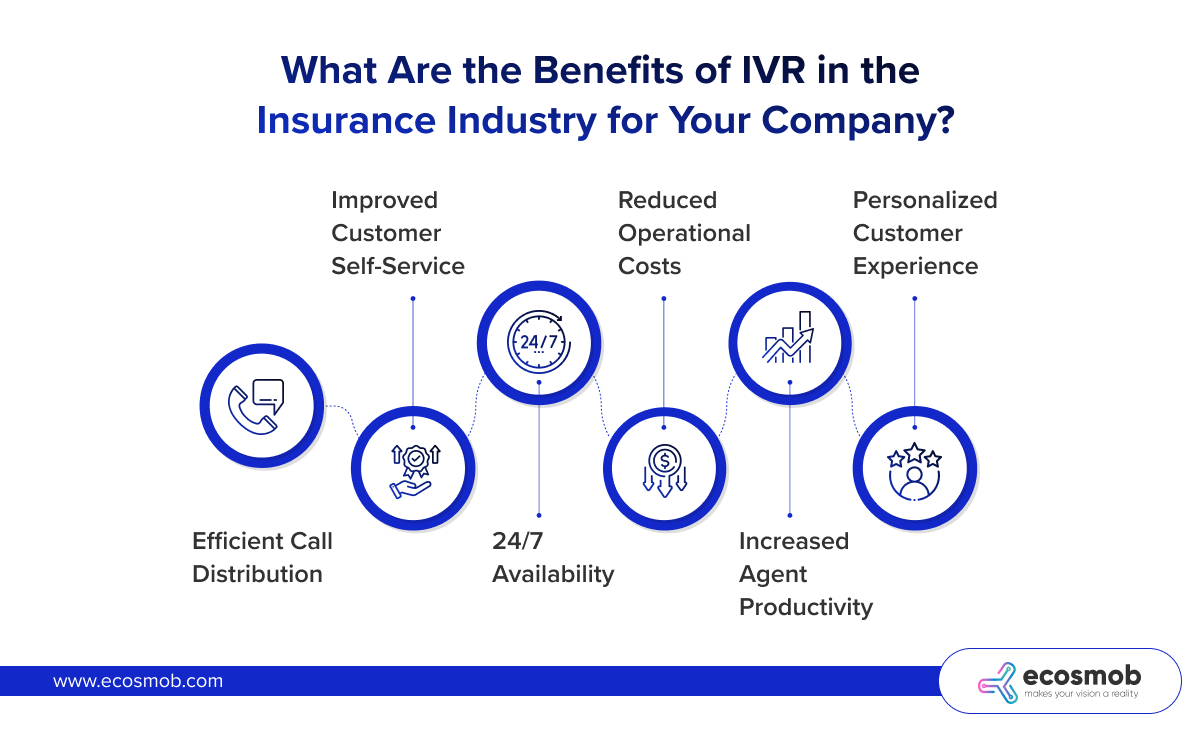

What Are the Benefits of IVR in the Insurance Industry for Your Company?

Implementing an IVR system in your insurance operations isn’t just about automation. Below are key advantages that IVR solutions bring to the insurance industry:

1. Efficient Call Distribution

With IVR, incoming calls are intelligently routed to the right department or agent based on the customer’s input. Whether someone is calling to make a payment, ask about a policy, or check a claim status, IVR ensures they reach the right place without bouncing between agents. This speeds up resolution times and creates a more professional experience.

2. Improved Customer Self-Service

IVR helps your policyholders to do things on their own like updating contact information, requesting policy details, or making a payment without speaking to a live agent. This level of self-service reduces friction, increases satisfaction, and frees up your support team for more complex tasks.

3. 24/7 Availability

You will never know when your customer will need you, but the good thing is, unlike live agents, an IVR system works around the clock. Customers can call in at any time of the day or night and access the information or services they need. Whether it’s a policyholder trying to pay a premium at midnight or someone checking their claim status over the weekend, IVR makes your services available 24/7.

4. Reduced Operational Costs

IVR systems significantly reduce operational expenses by automating routine interactions and minimizing agent workload. You don’t need to scale your support team just to handle basic queries. This efficiency lets you focus your budget and resources on high-impact areas like claims resolution and customer retention.

If we talk about the real-world impact of IVR on operational costs, the numbers speak volumes. McKinsey data shows that a 5-20% improvement in IVR containment and a 15-25% increase in authentication can slash total call-center costs by 10-30% in just 3-6 months, which demonstrates a quick and significant financial benefit for insurance operations.

5. Increased Agent Productivity

When IVR handles repetitive and low-value calls, your agents can focus on more meaningful conversations like resolving disputes, managing complex claims, or advising on policy upgrades. This improves overall productivity, increases employee morale, and reduces burnout.

6. Personalized Customer Experience

In smart IVR solutions, you can integrate with your CRM software to deliver a personalized experience. Callers can be greeted by name, offered services based on their history, and routed to agents who are already familiar with their case. This makes your customers feel valued and understood, which is critical in the insurance industry.

A Step-by-Step Guide to Easily Setting Up an IVR Phone System

A Step-by-Step Guide to Easily Setting Up an IVR Phone System

1. Choose a Provider & Plan:

Start by researching various IVR service providers to identify one that aligns with your specific needs. Consider factors such as pricing, features, customer support, and scalability. Once you’ve found a suitable provider, sign up for an account and select a plan that matches your business size and anticipated call volume.

2. Get a Phone Number:

Select and acquire the right phone number for your business. You can opt for a local number, a toll-free number, or even a vanity number that reflects your brand. Check availability through your provider and ensure that the number is easy for your customers to remember.

For example, 1-800-GO-FEDEX is a well-known vanity number used by the global shipping company FedEx. 1 This type of memorable number directly relates to their service and makes it easy for customers worldwide to contact them for shipping needs. Choosing a number that clearly communicates your service or brand can be a powerful marketing tool.

3. Access IVR Builder:

After securing your phone number, log into your provider’s platform and navigate to the IVR or call flow section. This is typically found in the main dashboard or settings menu, where you will be able to create and manage your call flows.

4. Design Your Menu:

Take time to plan your IVR menu options carefully. For example, you might include prompts such as “Press 1 for Sales,” “Press 2 for Customer Support,” or “Press 3 for Billing Inquiries.” Record or upload clear and professional greetings and menu options.

Utilize the IVR builder to establish connections between actions, including playing audio messages, gathering user input through keypad entries, and routing calls to different departments based on the choices made by the caller.

5. Test Thoroughly:

Before going live, it’s crucial to perform comprehensive testing on your IVR system. Call your designated phone number and systematically check each option in your menu. Ensure that routing works correctly and that callers are directed appropriately. Take note of any issues, like confusing phrasing or long wait times, and adjust accordingly.

6. Assign IVR to Number:

Once you’ve finalized your IVR setup and ensured its functionality, link your completed IVR flow to the phone number you acquired earlier. This step usually involves selecting your IVR flow from a dropdown menu in the provider’s platform settings.

7. Go Live & Monitor:

After assigning the IVR to your phone number, it’s time to inform your customers about the new system. Promote it through your website, email newsletters, and social media platforms. Once live, monitor call logs and customer interactions to gather data on effectiveness. Use this information to make any necessary adjustments or enhancements to improve the caller experience over time.

Too many calls, not enough agents? Automate with IVR

In summary, an IVR solution for your insurance company will help you with various operations. You can use it to process payments, gather customer feedback, and check the claim status while maintaining security and compliance guidelines. These several use cases will help you to enjoy the benefits of having a smart IVR solution, such as efficient call distribution, improved customer self-service, 24*7 availability of customer support, and reduced operational costs. It will also help increase agents’ productivity by managing the workload using an IVR and integrating with CRM to provide a personalized customer experience.

At Ecosmob, we’re experts at creating smart IVR solutions just for insurance companies. Our customized IVR systems can easily manage high call volumes, work on the cloud, follow important rules like HIPAA and PCI-DSS, and connect with your existing CRM systems.

See how a custom IVR can help. Contact Us Today.